Banking on the Future: Exploring the World of Finance

SEO Description: Discover the latest trends and insights in finance with "Banking on the Future: Exploring the World of Finance." Stay informed and ahead of the game!

Meta Keywords: Future of banking Finance trends Banking innovations Financial technology Future of finance industry Digital banking Fintech solutions Financial services Banking technology Finance industry insights Online banking Mobile banking Financial sector Banking strategies Finance technology Banking trends Financial institutions Banking solutions Financial market Investment banking Banking regulations Finance management Banking sector Financial planning Banking technology trends

Banking on the Future: Exploring the World of Finance 2025

Finance, a world that is constantly evolving and shaping the way we manage our money, investments, and assets. As we step into the future of banking and finance in 2025, the landscape is changing at a rapid pace, with new technologies, regulations, and trends reshaping the industry as we know it. In this article, we will delve into the exciting world of finance and explore what the future holds for banking and financial services.

The Evolution of Finance

Over the years, the finance industry has undergone a significant transformation, moving from traditional brick-and-mortar banks to digital banking and fintech solutions. With the rise of technology and the internet, customers now have more options than ever before when it comes to managing their finances.

Mobile banking apps, online investment platforms, and digital wallets have revolutionized the way we interact with our money, making it easier and more convenient to access and manage our finances on the go. As we look towards 2025, we can expect to see even more advancements in technology that will further streamline and enhance the banking experience for customers.

The Impact of AI and Machine Learning

One of the most significant trends shaping the future of finance is the integration of artificial intelligence (AI) and machine learning into banking systems. These technologies are revolutionizing how banks and financial institutions operate, allowing them to analyze vast amounts of data in real-time and provide personalized services to customers.

AI-powered chatbots, predictive analytics, and fraud detection systems are just a few examples of how AI is transforming the banking industry, making it more efficient, secure, and customer-centric. In 2025, we can expect to see even more advancements in AI and machine learning that will further enhance the capabilities of financial institutions and improve the overall banking experience for customers.

Blockchain and Cryptocurrency

Another trend that is reshaping the world of finance is the rise of blockchain technology and cryptocurrency. Blockchain, a decentralized and secure digital ledger, is revolutionizing how transactions are recorded and verified, making them more transparent and secure.

Cryptocurrencies like Bitcoin, Ethereum, and Ripple are changing the way we think about money, enabling faster, cheaper, and more secure transactions across borders. As we move towards 2025, we can expect to see even more adoption of blockchain technology and cryptocurrencies in the financial industry, leading to greater efficiency, transparency, and security in transactions.

Regulatory Challenges and Opportunities

As the world of finance continues to evolve, so do the regulatory challenges and opportunities that come with it. Governments and regulatory bodies are constantly adapting to new technologies and trends in the industry, ensuring that banks and financial institutions operate in a safe and compliant manner.

The implementation of regulations like PSD2, GDPR, and Open Banking are reshaping the future of finance, promoting competition, innovation, and data protection in the industry. In 2025, we can expect to see even more regulatory changes that will impact how banks and financial institutions operate, creating both challenges and opportunities for the industry as a whole.

Exploring the Future of Finance

As we look towards 2025, the future of finance is filled with exciting possibilities and challenges. From the integration of AI and blockchain technology to the rise of digital banking and cryptocurrencies, the industry is undergoing a rapid transformation that will reshape how we manage our money and investments.

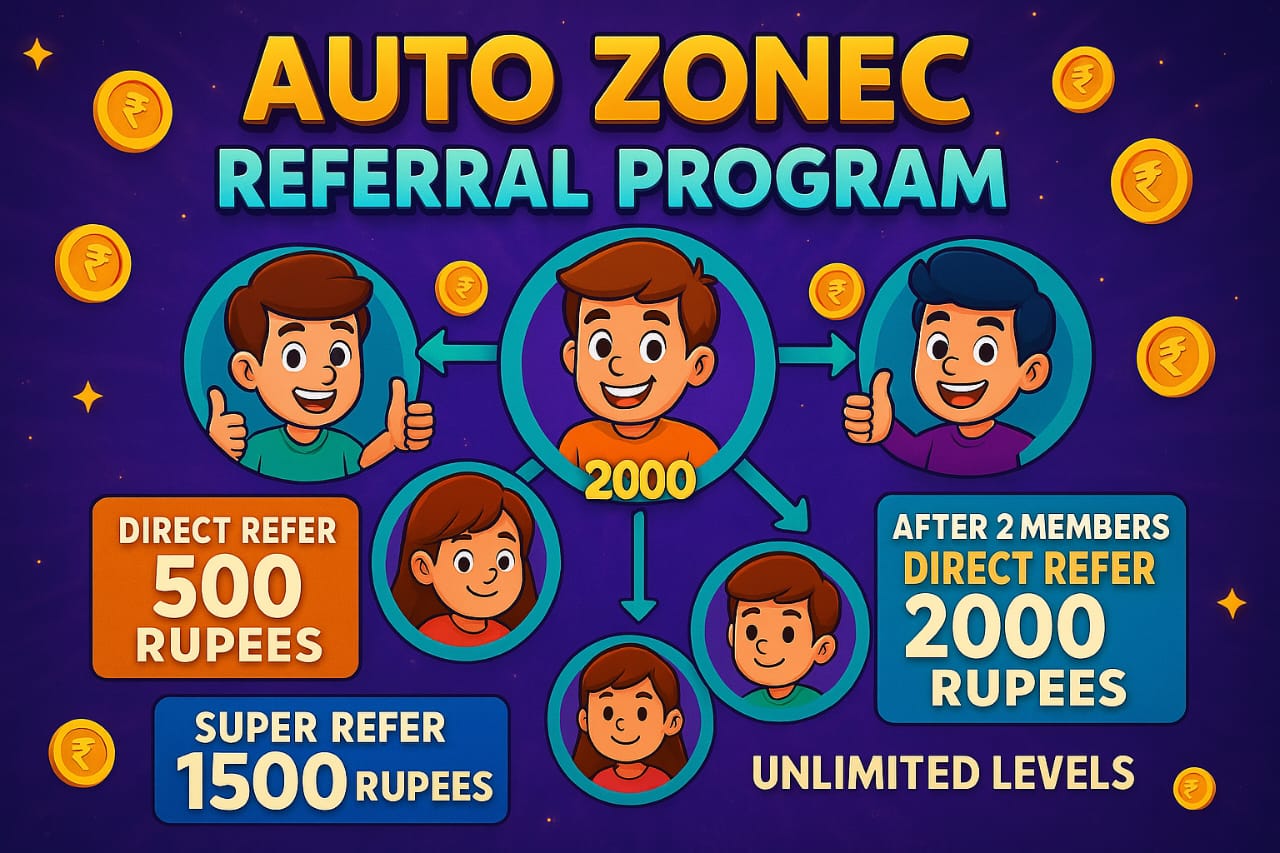

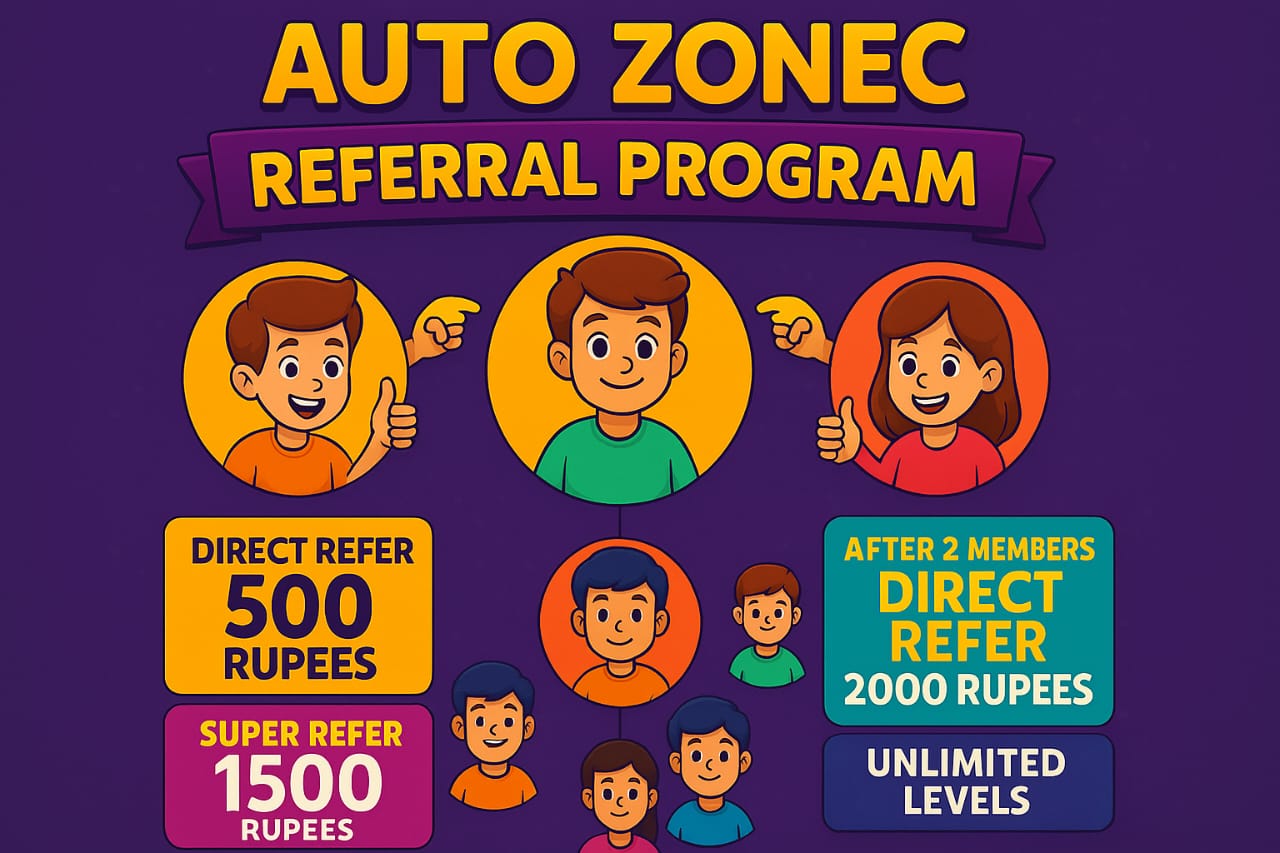

At Autozonec Wiki, we are committed to exploring the world of finance and keeping you informed about the latest trends and developments in the industry. Visit our blog for more insights and information on banking, finance, and technology.

Stay tuned as we continue to explore the world of finance and banking in 2025 and beyond. The future is bright, and we are excited to be a part of it!

For more information and insights on the world of finance, visit our blog and discover the tools and resources that will help you navigate the ever-changing landscape of banking and finance.

Banking on the Future: Exploring the World of Finance 2025 - Together, we can shape the future of finance!

In today's fast-paced world, the field of finance is constantly evolving, with new technologies and strategies shaping the way we handle money. As we look towards the future of banking, it's important to stay ahead of the curve and explore innovative strategies that can help us navigate the complex world of finance. Here are five real-life strategies that can help you navigate the world of finance and secure your financial future: 1. Diversify Your Investments: One of the most important strategies in finance is to diversify your investments. By spreading your investments across different assets such as stocks, bonds, real estate, and commodities, you can reduce your risk exposure and increase your chances of generating higher returns. Diversification can help you weather market fluctuations and protect your portfolio from potential losses. To help you identify the best investment opportunities, consider using tools like ChatGPT to analyze market trends and make informed decisions. ChatGPT is an AI-powered chatbot that can provide you with valuable insights and recommendations based on real-time data and market analysis. 2. Create a Financial Plan: Another key strategy in finance is to create a comprehensive financial plan that outlines your short-term and long-term financial goals. A financial plan can help you track your progress, identify areas for improvement, and make informed decisions about your money. To create a professional-looking financial plan, consider using tools like Canva to design visually appealing templates and graphics. Canva offers a wide range of customizable templates that can help you create a personalized financial plan that reflects your unique goals and aspirations. 3. Invest in Yourself: In today's competitive job market, it's more important than ever to invest in yourself and acquire new skills that can help you stand out from the crowd. Whether you're looking to advance your career or start a new business, continuous learning and self-improvement are essential for success in the world of finance. To enhance your skills and knowledge, consider enrolling in online courses like those offered by AutoZoneC. AutoZoneC offers a wide range of finance courses that cover topics such as investment management, financial planning, and risk management. By investing in your education, you can gain a competitive edge and position yourself for success in the finance industry. 4. Leverage Freelance Services: If you're looking to expand your financial portfolio or launch a new business venture, consider leveraging freelance services to access top talent and expertise. Platforms like Fiverr connect businesses and individuals with freelance professionals who can provide a wide range of services, from financial consulting to graphic design. By outsourcing tasks to freelance experts, you can save time and money while gaining access to specialized skills and knowledge. Whether you need help with financial analysis, market research, or branding, freelance services can help you achieve your goals and drive growth in your business. 5. Stay Informed and Adapt: In the fast-paced world of finance, staying informed and adapting to changing market conditions is crucial for success. Keep up to date with the latest industry trends, economic indicators, and regulatory changes that may impact your investments and financial decisions. To stay informed, consider subscribing to financial news websites, attending industry conferences, and networking with other professionals in the finance industry. By staying ahead of the curve and adapting to new challenges, you can position yourself for success and secure your financial future. As you navigate the world of finance, remember to be proactive, flexible, and open to new opportunities. By implementing these real-life strategies and leveraging tools like ChatGPT, Canva, and Fiverr, you can build a strong financial foundation and achieve your long-term goals. The future of banking is full of possibilities – are you ready to seize them? To learn more about finance and investment strategies, check out our courses at AutoZoneC and take the first step towards a brighter financial future. External Link: [Forbes - How Artificial Intelligence is Transforming the Finance Industry](https://www.forbes.com/sites/forbestechcouncil/2021/09/27/how-artificial-intelligence-is-transforming-the-finance-industry/?sh=322bb1c44a8e) In exploring the world of finance, there are three deep insights that can help us understand the dynamics of banking on the future. These insights shed light on the complexities of the financial industry and provide valuable knowledge for anyone looking to navigate this ever-evolving landscape. 1. Technology is reshaping the banking industry - The rise of financial technology, or fintech, has revolutionized the way banks operate and interact with their customers. - Online banking, mobile apps, and digital payment platforms have become the new norm, making banking more convenient and accessible than ever before. - Artificial intelligence and machine learning are being used to analyze data, detect fraud, and personalize customer experiences. Takeaway: Embracing technology is essential for banks to stay competitive and meet the evolving needs of their customers. Investing in innovative solutions can help institutions streamline operations, improve security, and deliver superior services. According to McKinsey, digital banking adoption has accelerated by 5 years due to the COVID-19 pandemic, further emphasizing the importance of technology in the banking sector (source: https://www.mckinsey.com/industries/financial-services/our-insights/the-next-normal-the-future-of-banking-after-covid-19). 2. Sustainable finance is gaining traction - With increasing awareness of environmental and social issues, sustainable finance has emerged as a key focus for many financial institutions. - Green bonds, social impact investing, and ESG (Environmental, Social, and Governance) criteria are becoming mainstream practices in the industry. - Consumers are demanding more transparency and accountability from banks, pushing them to adopt sustainable practices in their operations and investments. Takeaway: Incorporating sustainability into financial strategies is not just a trend, but a necessity for banks to build trust, mitigate risks, and drive long-term value. By aligning with sustainable goals, institutions can attract socially conscious investors and contribute to a more sustainable future. Research from Deloitte shows that sustainable finance assets are projected to reach $53 trillion by 2025, indicating a growing shift towards responsible investing in the financial sector (source: https://www2.deloitte.com/us/en/insights/industry/financial-services/sustainable-finance.html). 3. Regulatory compliance remains a top priority - The banking industry is highly regulated to ensure stability, protect consumers, and prevent financial crimes such as money laundering and fraud. - Compliance requirements are constantly evolving, with new regulations and standards being introduced to address emerging risks and challenges. - Banks must invest in robust compliance programs, technology, and training to meet regulatory expectations and avoid costly penalties. Takeaway: Prioritizing regulatory compliance is non-negotiable for banks, as failure to comply can result in severe consequences, including fines, reputational damage, and legal implications. By staying informed and proactive, institutions can navigate the regulatory landscape effectively and build a culture of compliance. In conclusion, the world of finance is a complex and dynamic ecosystem that is constantly evolving. By understanding the impact of technology, sustainable finance, and regulatory compliance, banks can position themselves for success in the future. Embracing innovation, sustainability, and compliance will be key drivers for growth and resilience in an increasingly competitive and challenging industry. "Banking on the Future: Exploring the World of Finance" is a comprehensive guide to understanding the complex world of banking and finance. Whether you are a student considering a career in finance or a curious individual looking to expand your knowledge, this article will provide you with valuable tips to navigate the world of finance effectively. Do's:- Educate yourself: Take the time to learn about the various financial products and services offered by banks, as well as the different investment options available to you. This will help you make informed decisions about your finances.

- Build a strong foundation: Establish a solid understanding of basic financial concepts such as budgeting, saving, and investing. This will serve as the groundwork for more advanced financial decisions in the future.

- Seek guidance: Don't be afraid to consult with financial experts or advisors to help you navigate complex financial matters. Their expertise can provide valuable insights and guidance.

- Diversify your investments: Spread your investments across different asset classes to minimize risk and maximize returns. Diversification is key to building a well-rounded investment portfolio.

- Stay informed: Keep up-to-date with the latest financial news and trends to make informed decisions about your investments. Knowledge is power in the world of finance.

- Don't ignore your finances: Avoid neglecting your financial health and take proactive steps to manage your money effectively. Ignoring your finances can lead to unnecessary stress and financial hardships.

- Don't make impulsive decisions: Take the time to carefully consider your financial decisions and avoid making impulsive choices. Rushed decisions can lead to costly mistakes in the long run.

- Don't overlook the fine print: Always read and understand the terms and conditions of financial products before committing to them. Pay attention to fees, interest rates, and other important details to avoid surprises later on.

- Don't rely solely on one investment: Avoid putting all your eggs in one basket by diversifying your investments. This will help spread risk and protect your portfolio from market fluctuations.

- Don't be afraid to ask questions: If you don't understand a financial concept or product, don't hesitate to ask for clarification. It's better to seek clarification than to make uninformed decisions.

Case Study: The Rise of Digital Banking

In recent years, traditional banks have faced stiff competition from digital banks that offer convenient, user-friendly online and mobile banking services. One such example is Chime, a digital bank that has gained popularity for its fee-free accounts and early direct deposit options. This shift towards digital banking highlights the importance of financial institutions adapting to meet the changing needs and preferences of consumers in an increasingly digital world.FAQs

1. What are the benefits of digital banking?

Digital banking offers convenience, 24/7 access to accounts, lower fees, and often higher interest rates compared to traditional banks. It also allows for easier money management through features like budgeting tools and mobile check deposit.

2. Is my money safe in a digital bank?

Just like traditional banks, digital banks are FDIC-insured up to $250,000 per depositor, per insured bank. This means that your money is protected in the event of a bank failure.

3. How can I learn more about finance and banking?

For those interested in diving deeper into the world of finance, consider enrolling in online courses that cover topics such as personal finance, investing, and banking. Check out our courses at here to get started on your financial education journey.

Don't miss out on the opportunity to expand your knowledge and take control of your financial future today!Banking on the Future: Exploring the World of Finance

Written by: mahnoor

Published on: April 25, 2025